American Household Debt Hits Alarming Record High of $17.5 Trillion

This post was originally published on

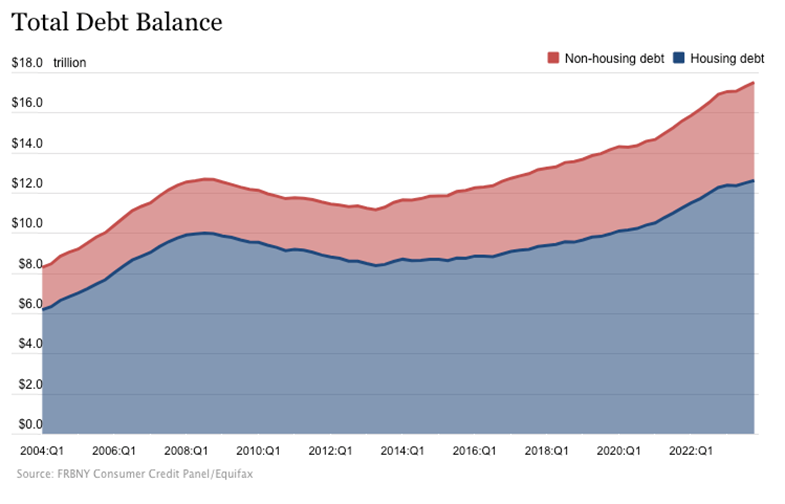

In an eye-opening revelation, the New York Federal Reserve has sounded an alarm over the burgeoning American household debt, which has breached new heights, according to a recent report. The figures are staggering, with household debt escalating by $212 billion in the last quarter alone, culminating in a record-breaking $17.5 trillion. This translates to an average of approximately $141,000 in debt per American household, marking an increase of $2,000 from the previous quarter. Since the advent of the pandemic, household debt has surged by an astronomical $3.5 trillion, a figure that ominously excludes the federal debt, which itself has swelled by $10 trillion in the same timeframe.

The comprehensive breakdown of this debt reveals that Americans are shouldering $12.3 trillion in mortgages, which has increased by $112 billion over the last quarter. Additionally, auto loans and student loans each account for $1.6 trillion. Credit card debt has hit a historic peak at $1.1 trillion, up by $50 billion, representing a concerning 20% annualized growth rate. With credit card debt averaging over $6,000 per household and interest rates hovering around 25%, the reliance on this form of last-resort borrowing is indicative of a precarious financial landscape.

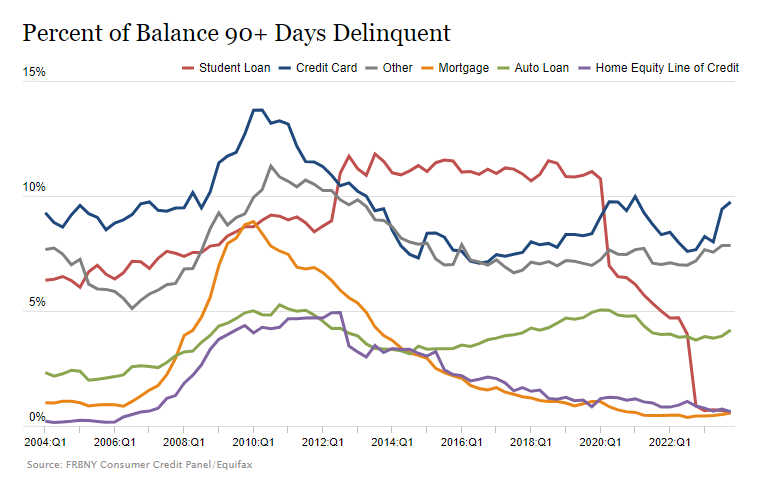

The New York Fed has expressed particular concern over default rates. During the pandemic, a significant drop in defaults was observed as Americans utilized stimulus checks to pay down debts and curtailed spending on non-essentials due to lockdowns. However, as pandemic savings dwindle, default rates are on the rise once again. The report highlights car loans as the potential first domino to fall, with the New York Fed pinpointing this sector for imminent defaults. This is attributed to the combination of inflated car prices, stimulus-induced down payments, and temporarily inflated credit scores during the pandemic.

Additionally, home equity lines of credit have surged for the seventh consecutive quarter, a trend often associated with financial distress among homeowners. Credit card delinquencies are climbing across all age demographics, with younger borrowers surpassing pre-pandemic levels, echoing the distress signals last seen during the 2008 financial crisis.

As defaults loom on the horizon, with retail sales already waning, the picture painted is one of an American consumer teetering on the brink. And this precarious situation is set to be further exacerbated by the specter of resurgent inflation. As we continue to monitor these developments, the consequences for the economy and individual households alike could be profound.