Bitcoin's Recent Ascent: Analysis of Current Trends and Market Sentiments

This post was originally published on

Bitcoin has recently reached a significant price milestone, trading above $52,000. This level has not been sustained for an extended period previously, marking a notable moment in Bitcoin's history.

Historical Perspective

The last time Bitcoin approached the $52,000 threshold, the landscape was markedly different. Trading entities like Celsius and Gemini Earn were offering yields on Bitcoin. Additionally, prominent figures and institutions such as Larry Fink of Blackrock have shifted their stance on Bitcoin, moving from skepticism to a more accepting view of the digital asset.

Source: CNBC

Network Strength

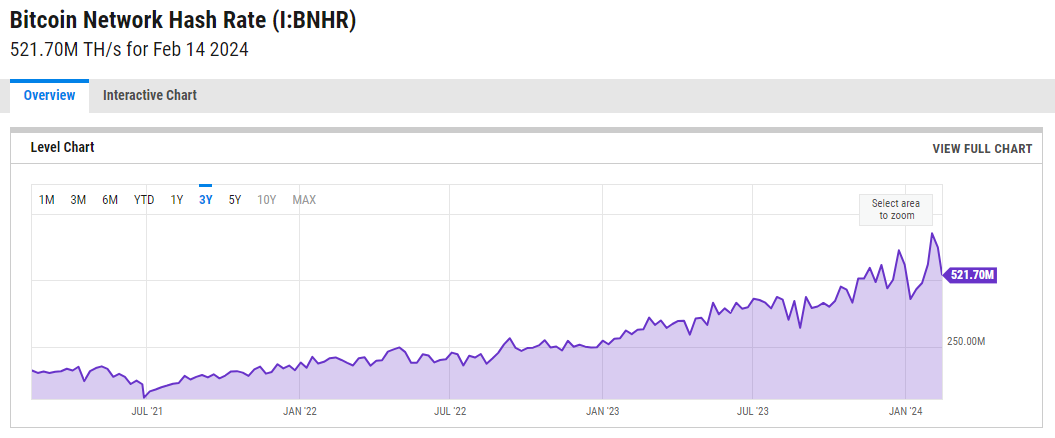

A critical measure of Bitcoin's underlying technology, the network hash rate, has seen a substantial increase. Currently, it is at 521 million terahashes, which is a significant rise from the 130 million terahashes recorded the last time Bitcoin traded at similar levels.

Source: ycharts.com

Bitcoin Adoption

The integration of Bitcoin into various financial products has led to increased exposure to the asset. Major companies have included Bitcoin on their balance sheets, and it is now indirectly owned by investors through indices like the Nasdaq Composite, Russell 2000, and S&P 600 via companies such as Tesla, Coinbase, and others.

Institutional Involvement

Asset management companies have begun incorporating Bitcoin into their offerings, with firms like Fidelity launching Bitcoin spot ETFs. These funds are not only profitable since their inception but are also being integrated into retirement portfolios, broadening Bitcoin's reach.

Source: MarketWatch

Market Sentiments and Trends

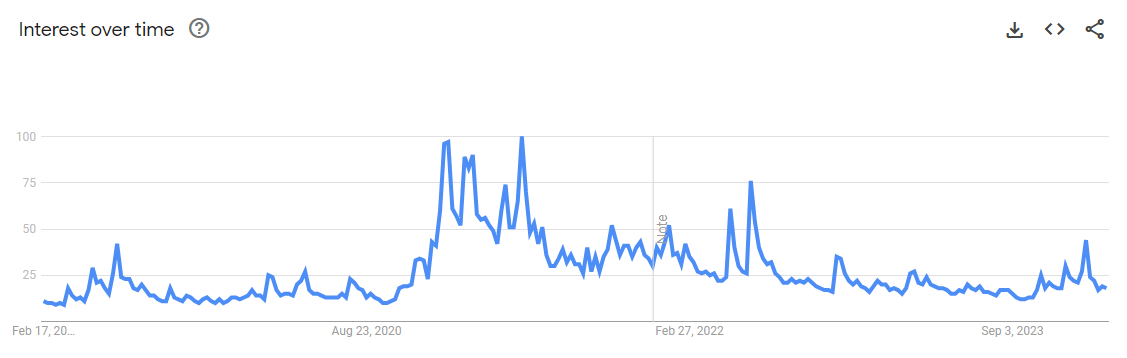

Despite the price increase, public interest in Bitcoin seems subdued, as indicated by Google Trends data. This could suggest that the current market cycle is still in its early stages, with potential for growth as sentiment shifts from neutral to bullish.

Google Trends data for search term "bitcoin"

ETFs and Unit Bias

The advent of Bitcoin ETFs addresses the issue of unit bias by allowing investors to purchase shares at a fraction of the price of a full Bitcoin, making the asset more accessible.

Altcoins

Altcoins have been underperforming relative to Bitcoin, with even robust alternatives like Monero losing ground against the leading cryptocurrency, a trend that is uncommon in bull markets.

Supply Dynamics

With the upcoming Bitcoin halving, the supply of new Bitcoins will decrease, potentially intensifying the demand-supply imbalance. This event is anticipated to fuel further price appreciation, as historical patterns have shown.

Credibility and Market Evolution

Bitcoin's credibility is expected to increase with the growing interest from large-scale investors such as family offices, sovereign wealth funds, and hedge funds. This new wave of investment could signal the beginning of a significant shift in Bitcoin's market positioning.

Conclusion

Bitcoin's recent price surge is backed by strong fundamentals, growing institutional interest, and an expanding adoption rate. With the halving event approaching, the market shows signs of entering a new phase of growth. Despite some skepticism, the overall market dynamics suggest a positive outlook for Bitcoin's future valuation and integration into the broader financial ecosystem.