ETFs, Self Custody, and Bitcoin Eating The World | Ten31 Timestamp 825,629

This post was originally published on

After months of hype and several highly entertaining false starts, the SEC finally approved 11 spot bitcoin ETFs on Wednesday of this week – exactly 15 years after Hal Finney’s iconic “running bitcoin” tweet – with trading commencing the following day. While the dust has yet to settle on exactly how early flows will shake out and the market’s hysterics leading up to the approval were undoubtedly a sideshow, we do expect these vehicles will make it easier for traditional pools of capital to flow into bitcoin, with positive implications for bitcoin’s price over time. More importantly, though, these ETFs represent the latest piece of clear evidence of Ten31’s thesis that bitcoin is eating the world. After years of deriding bitcoin as not just uninteresting but even outright harmful, the leaders of the legacy financial system just spent the last several weeks in a sprint to not only secure approval for their bitcoin ETFs but also to outdo each other in extolling bitcoin’s unique virtues on mainstream news appearances. Most notably, Larry Fink, who just a few years ago called bitcoin an “index of money laundering,” took to multiple broadcasts to promote bitcoin as an “asset that protects you.”

[

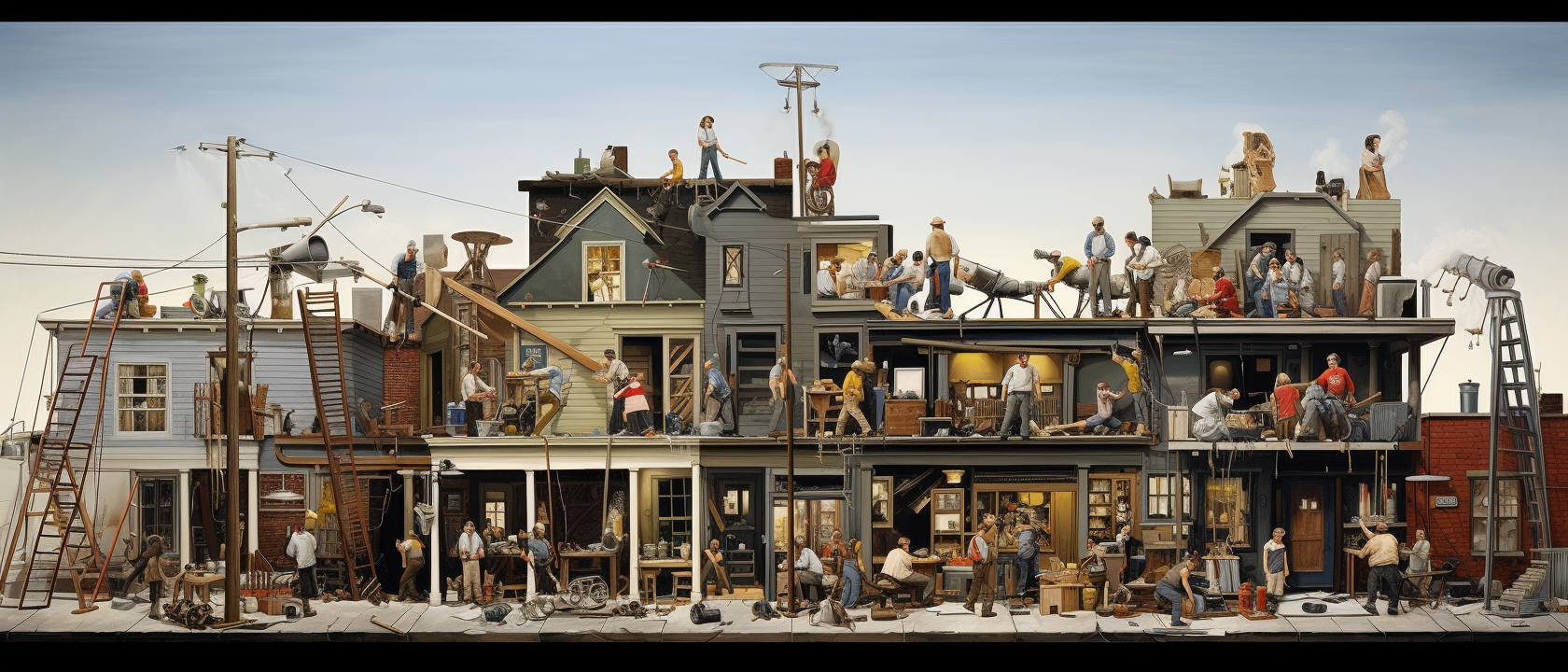

Bitcoin is Eating the World

An Investor’s Case for the Biggest TAM on Earth.

TFTC – Truth for the CommonerJohn Arnold

TFTC – Truth for the CommonerJohn Arnold

](

While Larry clearly still doesn’t fully get it, this diametric shift in tone is emblematic of the fact that, sooner or later, every self-interested economic actor will have to embrace bitcoin. We expanded on the derivative implications of this reality in a longform piece out this week titled Bitcoin is Eating the World, where we walk through what growing mainstream acceptance of and interest in bitcoin means for the still highly underappreciated bitcoin infrastructure ecosystem. The ETFs are certainly a bullish milestone and signpost, but they are still just a very early indication of the wave of mainstream adoption we see coming over the next decade, and this wave will have seismic implications for early investors in bitcoin’s enabling technologies.

Portfolio Company Spotlight

Unchained, Strike, Coinkite, Mempool.space, and AnchorWatch are all great examples of products and services that allow anyone to easily buy, protect, and use bitcoin in a native and optimally secure way. Strike and Unchained provide intuitive and high quality on-ramps for both small and large purchases of verifiable, on-chain bitcoin; Coinkite offers the most secure, battle-tested way to protect bitcoin without the layers of counterparty risk inherent in an ETF and offers product for users of all skill levels; Mempool.space gives users unmatched data to make smart decisions about their bitcoin transactions; and platforms like Unchained and AnchorWatch allow for additional layers of abstraction that combine minimized counterparty risk with an easy, hands-off experience for clients. The technology supporting native use of bitcoin is still in its early days, but many companies in the Ten31 portfolio have already rolled out offerings that can collectively provide the same easy UX of ETF ownership with substantially better security guarantees.

Selected Portfolio News

Unchained offered an update on its 2024 roadmap:

Unchained also announced a new institutional lending program:

Media

Strike Founder and CEO Jack Mallers appeared on Bloomberg TV to discuss the impact of the bitcoin ETF approvals.

Parker Lewis, Ten31 Advisor and Zaprite Head of Business Development, joined the Bitcoin Frontier podcast to discuss some of his recent work.

Market Updates

After ten years since the first filing, months of speculation in 2H 2023, and countless Twitter Spaces discussions by newly-minted ETF experts, the SEC finally approved 11 spot bitcoin ETFs (after an errant tweet fiasco from its account, which apparently did not have 2FA).

All filings from major issuers including BlackRock, Fidelity, Ark, Bitwise, and more were approved, and those institutions issued late-breaking filings early in the week to reduce fees to near-zero levels, presumably indicating expectations for substantial flows over time. BlackRock and Fidelity lowered their fees to 25bps, and most issuers are offering no fees for the first 3-6 months.

As expected, the products broke records for day one ETF launches, with total volume across the vehicles exceeding $4.6 billion (and ~$2.5 billion net of GBTC activity).

Multiple legacy finance executives took to mainstream airwaves to promote bitcoin, with Larry Fink calling it “an asset that protects you” and WisdomTree CEO Jonathan Steinberg noting its 15-year track record is “superior to every other asset class.”

The week also saw a few notable updates on the macro front, as the CPI reading for December 2023 came in above expectations, potentially complicating the recently growing consensus around near-term Fed rate cuts.

That said, New York Fed President John Williams indicated earlier in the week that, in the Fed’s view, rates are now sufficiently high to get price inflation back to the central bank’s ostensible 2% target.

In the latest negative headline for commercial real estate, vacancy in US offices hit a new record of nearly 20% last year, the highest level on record since 1979.

Banks’ use of the Fed’s BTFP Facility – allegedly set to expire in March – soared to another high this week, as banks continue to arbitrage the spread between BTFP borrowing costs and interest paid on reserves at the Fed.

Regulatory Update

In its latest effort to make itself as irrelevant to global finance as possible, the UK’s Financial Conduct Authority (FCA) enacted new regulations that will require retail investors to pass a series of certifications and tests before being able to use centralized cryptocurrency exchanges.

Noteworthy

BitWise, issuer of the BITB spot bitcoin ETF, announced it would donate 10% of its profits from ETF fees to OpenSats for the next 10 years to help fund bitcoin and open source software development. VanEck, issuer of the HODL ETF, announced a similar 5% donation to Bitcoin Core development through Brink.

Multiple new Nostr-based media hosting applications have been released over the past several weeks, including an image hosting service and a video-sharing and directory application called Flare.

While BlackRock executives were busy pumping their bitcoin ETF this week, the Financial Times noted its various ESG initiatives have experienced a “catastrophic” decline in support among asset managers.

Travel

- Nashville BitDevs and Bitcoin Meetup, January 16-17

- Nashville Energy and Mining Summit, January 18-19

- Austin BitDevs, February 15

Learn more about Ten31, our investment thesis, portfolio companies, and funds by visiting our website.