The Zero Dollar Manifesto: Part One

This post was originally published on

What does it mean to “GetOnZero dollars”?

(Originally published on Sahil's Substack)

GetOnZero is a movement that’s challenging the belief that we need to hold dollars. That’s right: this means holding 0 dollars at all. Zero. None. With GetOnZero, you use bitcoin instead of the dollar as your money. GetOnZero as a framework helps to reframe the function of the dollar in our lives. (No, you don’t need to actively hold on to dollars to pay taxes.)

In adopting this framework, you are upgrading the money in your bank from one that can be printed and devalued at will (your dollars) to one that cannot (bitcoin). As I describe in my article Rethinking the function of fiat currency, removing the need to hold fiat for more than a millisecond allows us to completely sidestep financial debasement via monetary inflation.

Notably, “Getting on zero” doesn’t mean owning 100% bitcoin and nothing else. It just means holding 0 fiat. Having a roof over your head, a car to get around, a piece of a business (equity), ammo, and gold all have a place.

You might think this is impossible, crazy, or even radical. I believe it’s the opposite. Rethinking the function of dollars (and holding none) is beautiful in its simplicity. Holding zero dollars allows us to avoid the traps of timing the market (“buying the dips”) and frees us up to produce more value, thus earning more bitcoin. In this series, I aim to make a case for Getting On Zero dollars being rational and being much more achievable than you may think_._

Bitcoin’s journey in a portfolio

For many of us, the start of our bitcoin journey involved “getting off zero” bitcoin–just dipping our toes in the water. Just a 1% hedge, “in case it catches on”, in the words of Satoshi Nakamoto.

As we start to dive down the rabbit hole–listening to bitcoin podcasts, reading articles, going to meetups and conferences–our conviction in bitcoin grows. Naturally, our exposure to this “investment” grows along with it–5% to 20% to 50% to 80% and more. Sound familiar?

The next step for bitcoin in your portfolio is learning from Pierre Rochard and Bitstein that bitcoin is a form of savings that can’t be debased rather than an “investment.” So the next morning after realizing this epiphany, you wake up and convert 100% of your stock and bond “investments” into bitcoin savings.

At this point, we’ve naturally reached the final logical step of upgrading 100% of cash in your checking account as well. It shouldn’t be, but in some ways this is the most challenging step. Let’s explore why we’d want to do this.

Playing “hot potato” with Weak Money

Say you’re visiting family in Spain, for a month-long vacation. How many dollars are you going to convert into euros? Likely, just enough for your trip. Why hold more of a currency that isn’t otherwise useful to you?

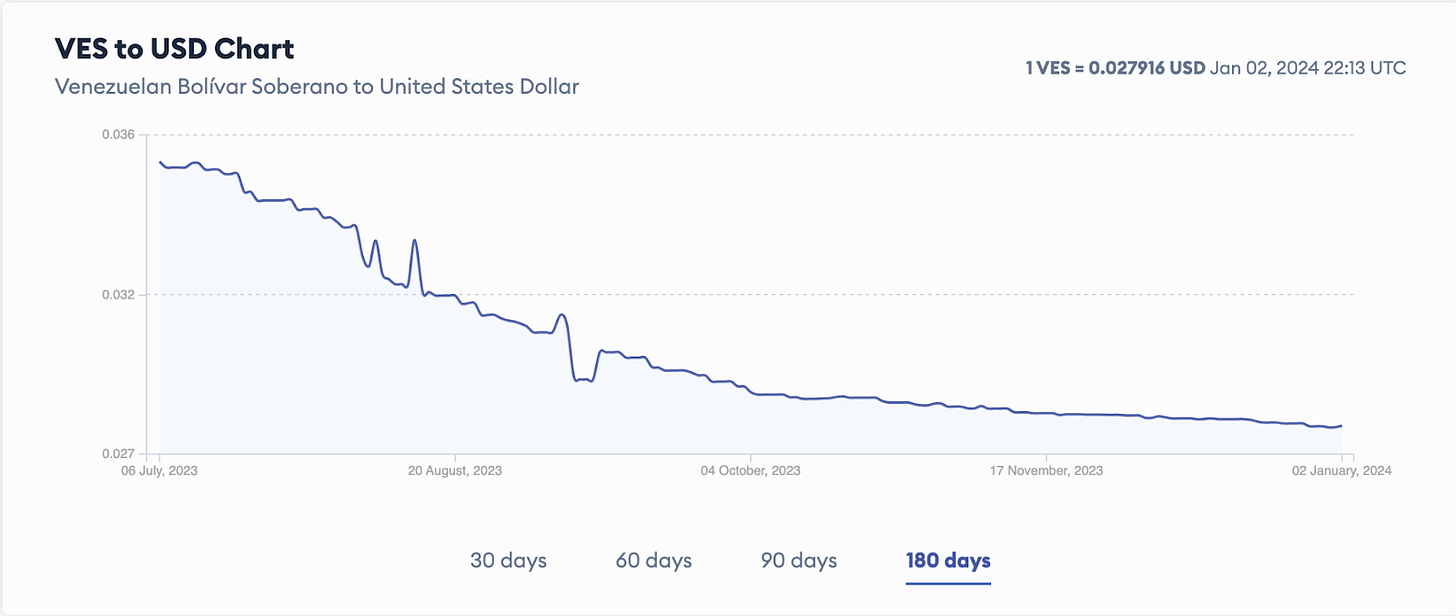

On the other hand, say you were visiting Venezuela instead. How much would you convert to bolivars? Likely just enough for the week, if not less. The rapid depreciation of bolivars means you’d come out ahead holding the stronger money (dollars) for as long as possible, and converting to the weak money (bolivars) only when needed.

The purchasing power of Weak Money always depreciates

Let’s take this idea of playing hot-potato with Weak Money to its logical extreme. What if you could convert the Strong Money into the Weak Money, but only the amount you need for the day?

What about just enough for the hour?

What about for the millisecond?

That’s what GetOnZero means–upgrading your money to the maximum extent possible. Save in Strong Money (bitcoin), and convert just as much as you need at the time of transaction (a millisecond) into Weak Money (dollars).

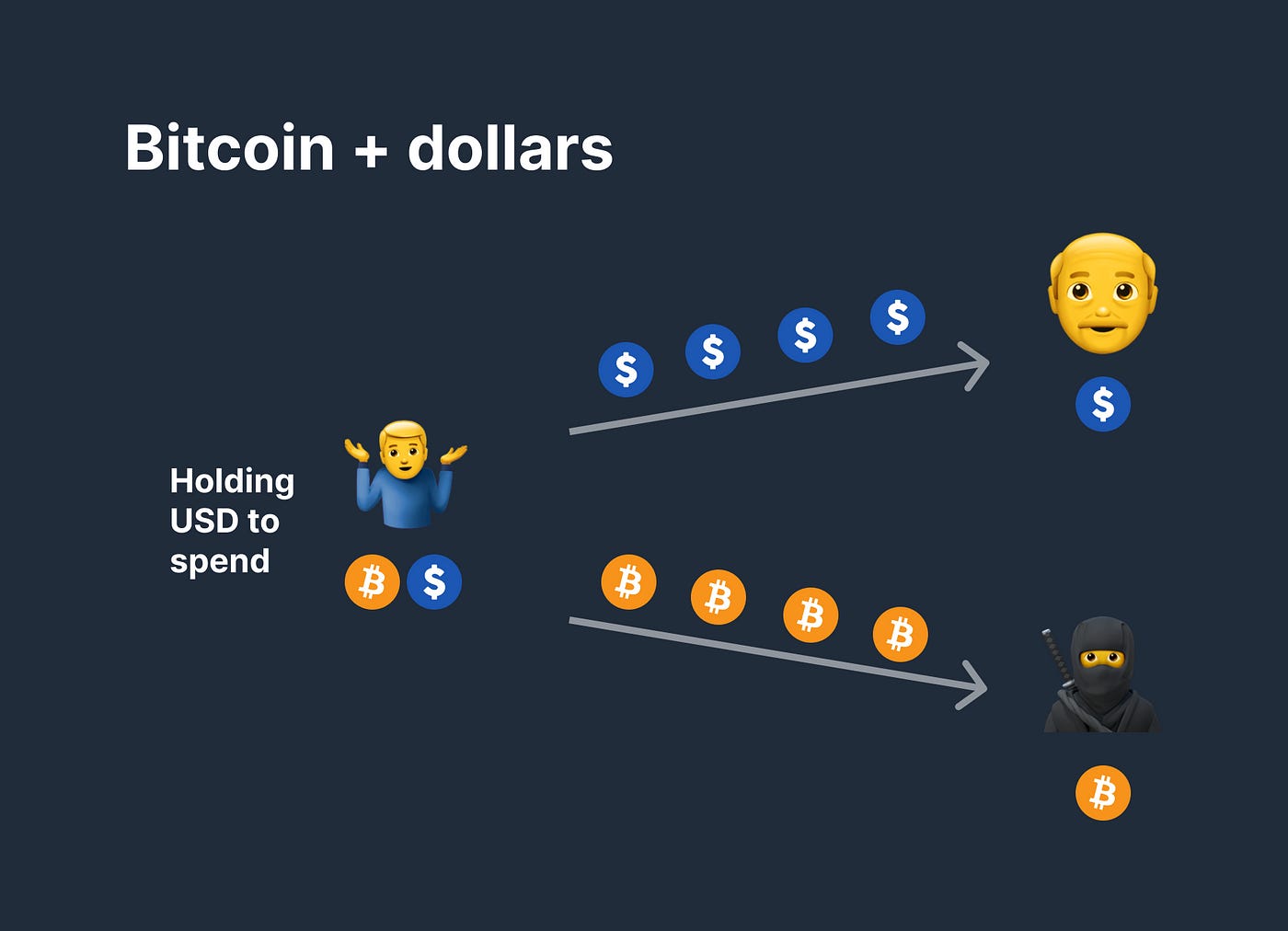

Dollars are a payment rail to move bitcoin

The dollar and bitcoin are both monetary assets that can be transferred, or sent, with the help of payment rails. Dollars can be moved around with the help of payment rails like the PayPal network, the ACH network, or the transfer of physical bills. Sats (smallest unit of a bitcoin) on the bitcoin network can be moved over bitcoin-native payment rails (on-chain, lightning, sidechains). Therefore, shouldn’t bitcoin–upgraded, Strong Money–be able to be moved/sent using any payment rail?

In the last section, we talked about converting Strong Money to Weak Money only at the time of transaction and no longer, to protect ourselves from Weak Money debasement. Going further and abstracting away that last millisecond, we can now see that the dollar is not an asset to hold. Rather, the dollar’s utility is really as a payment rails (alongside PayPal, lightning, ACH and physical bills) to move money (bitcoin). By distinguishing between holding the asset and using the rails, we can now envision a world where we have bank accounts that look familiar to what we see today, but using upgraded Strong Money–bitcoin–all the while remaining interoperable with legacy payment networks via the dollar.

Holding dollars just to spend with merchants who haven’t upgraded yet

Using the dollar as a payment rail to move bitcoi

As I describe in Rethinking the function of fiat currency–whether you are paying your mortgage bill or buying a cup of coffee–you and your counterparty have a choice to use bitcoin-native payment rails (superior) or legacy fiat payment rails (inferior). This way, your base money is bitcoin, but you are fully interoperable with the legacy fiat payment rails.

Should everyone do this?

To be clear — none of this should be dogmatic. This isn’t a purity test of who’s a “better bitcoiner”. At the end of the day, all of us who own bitcoin will win. That said, whether you’re considering your family’s balance sheet or your business’s, once the mental model clicks and you upgrade your money, there's no turning back.

Individuals & families

Eventually, everyone is a good candidate for getting “on zero” dollars. Upgrading your money to bitcoin however, definitionally requires both understanding and faith in bitcoin’s superior monetary properties. One must first understand (or at least, trust) why bitcoin’s monetary properties can be credibly enforced, before converting all of their weak money to strong money. It's a journey.

For example: if you are earlier on in your bitcoin journey and are allocating 2-10% of your “well-balanced” portfolio, GetOnZero may sound extreme (for now). On the other hand, if you’re been in bitcoin for some time and already have, say, 75-90% of your savings in bitcoin–YOU are who I am speaking to. I am speaking to those who have a level of conviction where going from 90% to 100% bitcoin is simply logical.

Businesses

Some take the view that businesses should not “speculate” on bitcoin, and should instead let shareholders buy bitcoin on their own. Those same people, however, don’t bat an eye when they tell you their business holds Weak Money (which is guaranteed to depreciate) on their balance sheet.

In principle, I don’t see much of a difference in operation between businesses and families, other than scale. You may need more working capital for a business compared to a family, but the logic is the same.

The same principles of Strong Money apply: dollars are a legacy payment rail to move Strong Money, rather than an asset to hold on your balance sheet. Michael Saylor (CEO of MicroStrategy) goes farther than most businesses, and puts all company savings in bitcoin. However, he currently still holds (and advocates for holding) Weak Money for operational expenses.

My guess is, at the moment, the tools don’t yet exist to quickly convert large amounts of working capital between Weak and Strong Money. If/when they do, I imagine Saylor would change his tune on currencies, and hold only Strong Money (while using Weak Money as a legacy payment rail).

The time to GetOnZero dollars is now

Why is now the time to upgrade your money?

It’s getting easier

I often hear that juggling between dollars and bitcoin is inconvenient. Today, this is honestly a fair point. For many who are 99% bitcoin, 1% dollars, it may not be worth the manual effort of buying, selling, tracking cost basis for tax purposes. However, where there’s a will, there’s a way - tools like Fold, Strike, Base, and Cash App are building features at a rapid rate that are increasing the convenience and usability of Strong Money. Very soon, it will be a no brainer.

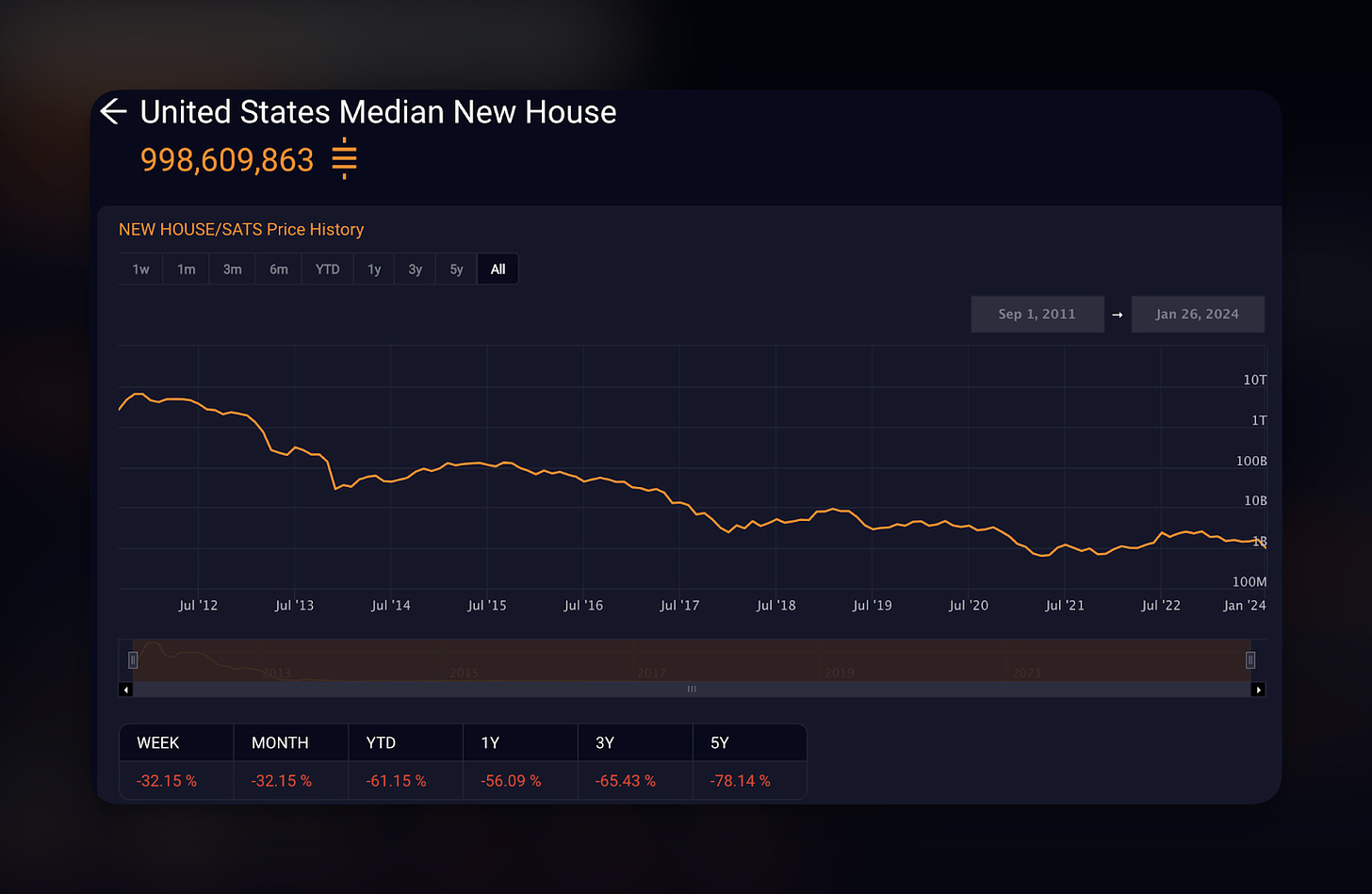

Everything gets cheaper

As I say in Rethinking the function of fiat currency: on average, every dollar held loses purchasing power, while every sat held gains purchasing power. Bitcoin can also be sent instantly and without permission from any authority. In other words, bitcoin has superior salability across both time and space compared to fiat currencies.

Everything gets cheaper when you upgrade to Strong Money.

When governments print Weak Money, they inflate the price of goods and services, denominated in that Weak Money. On the other hand, the price of those same goods and services go down in Strong Money terms. In other words, on average, your cost of living gets cheaper on a daily basis when you upgrade your money.

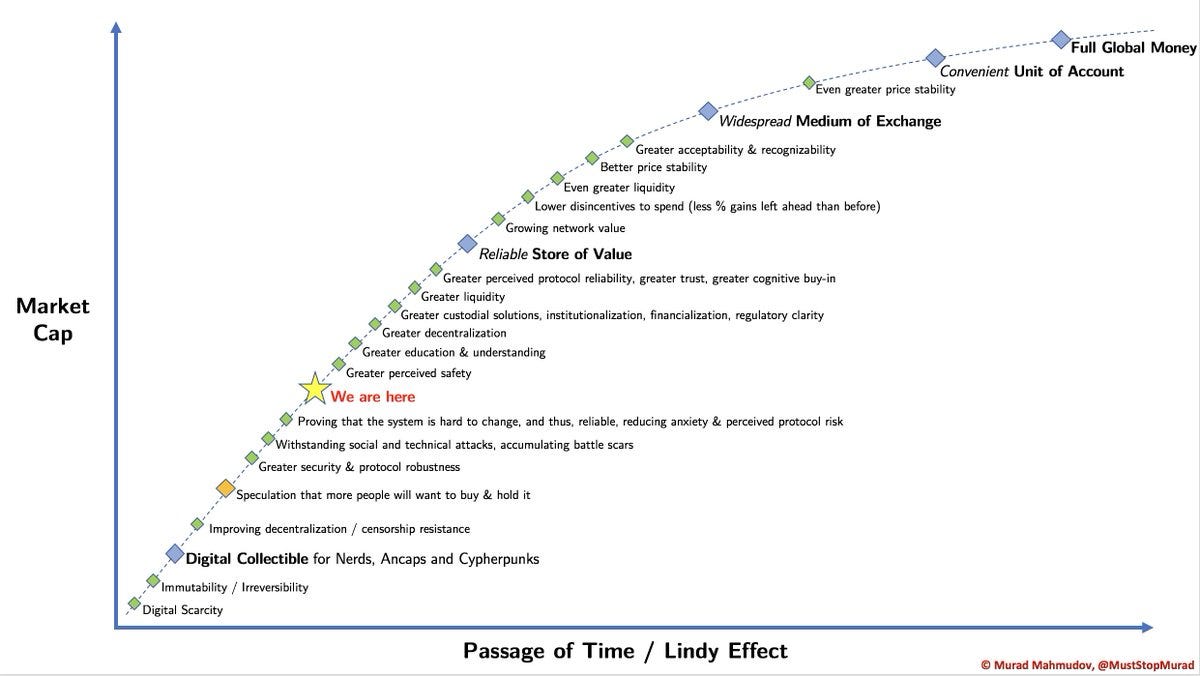

Source: @muststopmurad There’s no reason to wait.

I’m a fan of this graphic from Murad showing different phases of adoption of money. With that said, there’s absolutely no reason to wait for some vague notion of “hyperbitcoinization”, or bitcoin to be declared legal tender by your government. Once you understand that bitcoin is a superior store of value, it’s simply logical to go all the way and completely opt out of monetary debasement.

Why hold Weak Money at all?

Handling volatility

Volatility, specifically referring to exchange rate volatility against US dollars, doesn’t have to be scary. Bitcoin is upgraded money, and on average, your purchasing power will increase over time.

Regardless, there are ways of minimizing the impact of exchange rate volatility. For example, as long as your expenses are less than your income, spending on credit (eg. a credit card) allows you to pay off the line-of-credit from your income, directly as it comes in. This way, you sidestep exchange rate volatility completely. Over time, as your savings balance increases (and time goes by), you are more easily able to absorb that volatility (thanks to exponentially increasing purchasing power).

There are few cases when ignoring volatility can be easier said than done. Someone living paycheck to paycheck who upgrades their money to bitcoin at the “top” of a 4-year cycle (eg. $69,000 in 2021) may (reasonably) be terrified when bitcoin’s dollar exchange rate inevitably draws down 80% from its peak.

For that person, it’s true that for a short period of time, the purchasing power of their savings would decrease. It would also mean that their paychecks would acquire more units of upgraded money -- as the exchange rate goes down, you get more units of bitcoin. Once the exchange rate recovers, as it always does, they would end up with even greater savings. Remember that we cannot time the market, and on average, our savings will grow in purchasing power thanks to bitcoin’s immutable scarcity.

{Insert chart from Dylan I think? Showing people in profit even if they bought the top}

Reasonable minds can disagree on the approach here. One strategy is to make a decision like this gradually. In a way, we can upgrade our money over time, rather than all at once. For example, someone who has no savings at all may want to save up a year’s worth of Weak Money before upgrading, to be able to absorb any exchange rate volatility. Once they have a buffer for emergencies, then upgrading all your money becomes an easier sell.

We can upgrade our money over time

A different strategy employs the argument that monetary inflation impacts those with little-to-no savings the most, anyway. This is because a greater percentage of their (small) net worth is held in Weak Money. If someone has little-to-no savings anyway, monetary inflation impacts them the most since a greater percent of their net worth is held in Weak Money. Inflation is a regressive tax. These families are exposed to all the downside of fiat depreciation, with none of the upside of bitcoin. Is there really much to lose?

To say that the poor cannot save upgraded money is, frankly, condescending. Everyone should be able to save the fruits of their labor in the strongest form of money, rather than in a form that faceless bureaucrats quietly steal from.

Saving in Upgrading Money is the best hope of getting out of the paycheck-to-paycheck cycle.

Stop trying to “buy the dip” or “DCA”

Those who hold a dollar balance in order to “buy the dip” (i.e. when bitcoin’s exchange rate against dollars temporarily drops) are tacitly acknowledging that they are trying to time the market and behave like an active trader. Instead, think from first principles. Ignore the noise of market distractions, and stay laser focused. Stay humble, stack sats, and upgrade your money! If you GetOnZero, you will definitionally spend less time trying to time the market which will free up your time and energy to produce more value, thus earning more bitcoin.

Dollar-cost averaging (DCA), on the other hand, is a fair strategy for those who haven’t fully upgraded their money to bitcoin yet. Especially if you have self-awareness that you are not as able to handle the volatility of exchange rate fluctuations. However, DCA implies holding Weak Money for longer than you need to.

Beauty in simplicity

There’s something beautiful in the simplicity of upgrading your money. There’s no “hedge”, no complex basket of assets that make up your savings. There’s no need to differentiate between your checking account, savings account, emergency fund. It’s all just cash savings–as it used to be!

Pierre Rochard talks about the purpose of cash savings, as a hedge against future uncertainty. Bitcoin is the perfect form of cash. As a system, it perfects every property of money. By upgrading our money to bitcoin, we return to traditional wisdom of the golden ages. Cash savings are critical to hedge against future uncertainty. In other words: do your job, spend less than you make, save the rest. There’s something truly liberating in the simplicity of completely upgrading your money to bitcoin.

“The greatest gift bitcoin could give you is to stop thinking about bitcoin”

- ProgrammableTx

Michael Saylor (CEO of MicroStrategy) often shares his advice about curating your environment to achieve laser focus. By upgrading our money to bitcoin, we are achieving a similar end goal of radical simplicity. With so many distractions in our modern, over-financialized world, as Parker Lewis says, “bitcoin is the great definancialization”.

Freedom to spend (not sell)

Many fear becoming the “10,000 BTC pizza guy”. In 2010, Laszlo bought two pizzas for 10,000 bitcoins. To avoid this future regret of “spending” multigenerational wealth, many instead choose to “spend fiat, and stack sats”. In other words, they choose to spend their Weak Money and save in Strong Money.

Which makes sense, if you hold any Weak Money at all.

Unfortunately, in addition to ending up with less bitcoin, this also leads to a lack of incentive to spend bitcoin in peer-to-peer, bitcoin-native, privacy-preserving ways.

When you hold no Weak Money, and only hold Strong Money, all of a sudden you aren’t psychologically pinned down by the weight of your Weak Money. Tautologically, when you only have bitcoin to spend, you can only spend bitcoin! The psychological friction in spending Strong Money disappears overnight, and you feel more open to pay in bitcoin using bitcoin-native rails, helping to kickstart your local circular economy and protecting your financial privacy along the way.

In other words, you don’t “sell bitcoin” (for dollars). Instead, spend bitcoin when you need to, whether via bitcoin-native payment rails or via legacy rails (dollars).

Upgrading your money enables the bitcoin circular economy, one balance sheet at a time.

When you upgrade your money, spending bitcoin goes from being ideological to logical.

When to hold Weak Money

One of the reasons we want to upgrade our money is to sidestep financial debasement. In other words, to protect ourselves from fiat currency inflation, which is a hidden form of theft and lowers our purchasing power.

If there’s a large, fixed-amount expense in the very near future that is not affected by monetary inflation, and you want to protect yourself from short term volatility, I could see holding that amount of Weak Money. If you do that, you won’t benefit from the purchasing power increase of holding Strong Money, but you protect yourself from the short-term downside risk of exchange rate fluctuation.

This is an acceptable tradeoff in some circumstances where the amount is large, fixed, and in the near term. For example: you’re looking to put a $50,000 down payment on a house in the next few months. It’s unlikely that the purchasing power of $50,000 will radically depreciate in such a short period (at least, at the time of writing this article). You also miss out on the potential upside of holding Strong Money, but some may consider this a reasonable tradeoff for the short term promise of maintaining purchasing power.

OK, so how do we actually do this?

At this point, you may be wondering how the mechanics of this work.

- How do you actually pay bills denominated in dollars while holding bitcoin?

- What does it actually mean for dollars to be a payment rail to move bitcoin?

- What about taxes?

- How does this actually work under the good?

We’ll explore all of this and more in Parts 2 and 3 of the Zero Dollar Manifesto.

Engage & learn more

Have specific questions? Find me on Twitter @SahilC0 for Part 2 and 3, and join the GetOnZero Telegram group here.