Shifting Economic Winds: A Detailed Look at US Inflation Rates

This post was originally published on

The US consumer price index (CPI) is often cited as a key measure of inflation, and recent data released by the Bureau of Labor Statistics has shed light on the current inflationary trends within the US economy.

Recent CPI Data

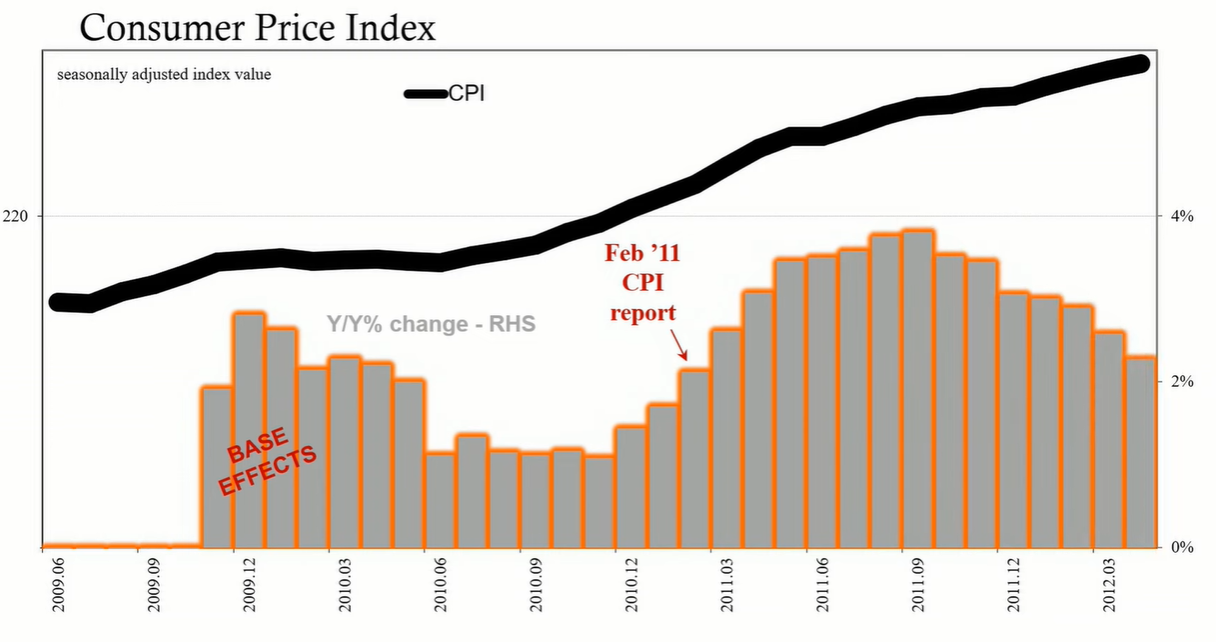

According to the Bureau of Labor Statistics, the CPI increased by 2.1% for the twelve months ending in February. This was a notable acceleration from the 1.6% increase in January. The bond market reacted to this news with a sell-off, leading to an increase in short-term interest rates. However, historical context is crucial. On March 17, 2011, similar concerns were raised regarding a potential breakout of significant inflation after a reported CPI increase. Yet, this turned out to be a transient supply shock.

Supply Shocks and Inflation

Supply shocks are typically temporary and often do not require aggressive central bank intervention to stabilize consumer prices. The 2011 supply shock, while initially concerning due to rising CPI numbers, ultimately had no lasting impact on long-term inflation or inflation expectations. This historical precedent suggests that current inflationary pressures might also be temporary.

Analyzing the CPI Components

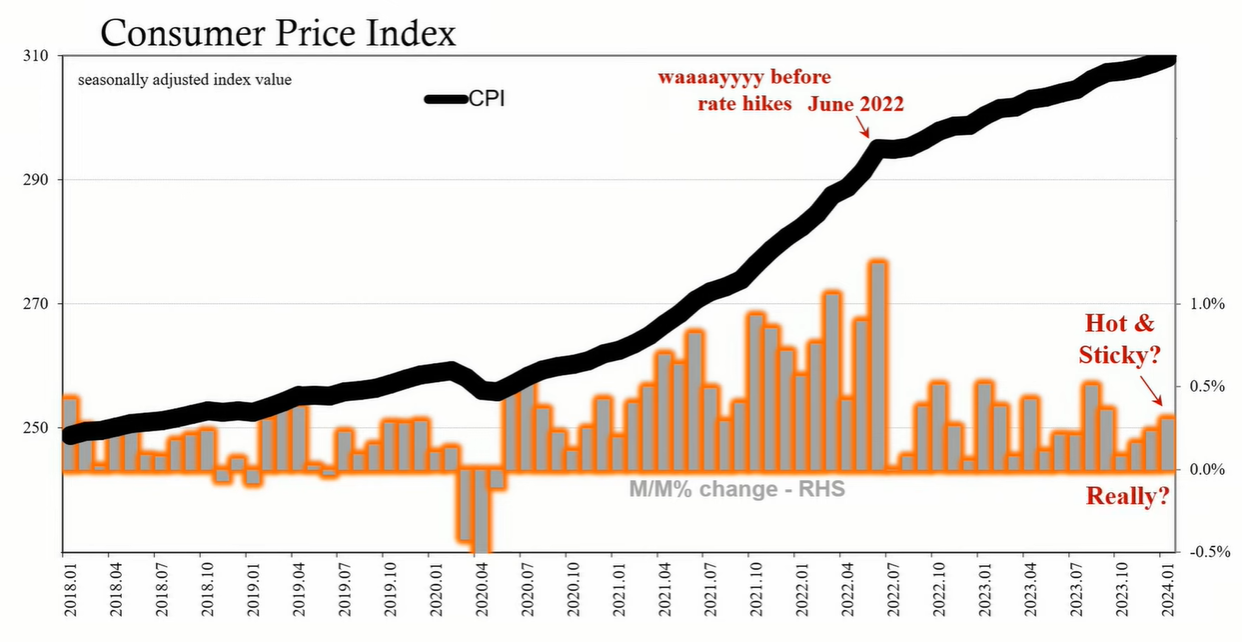

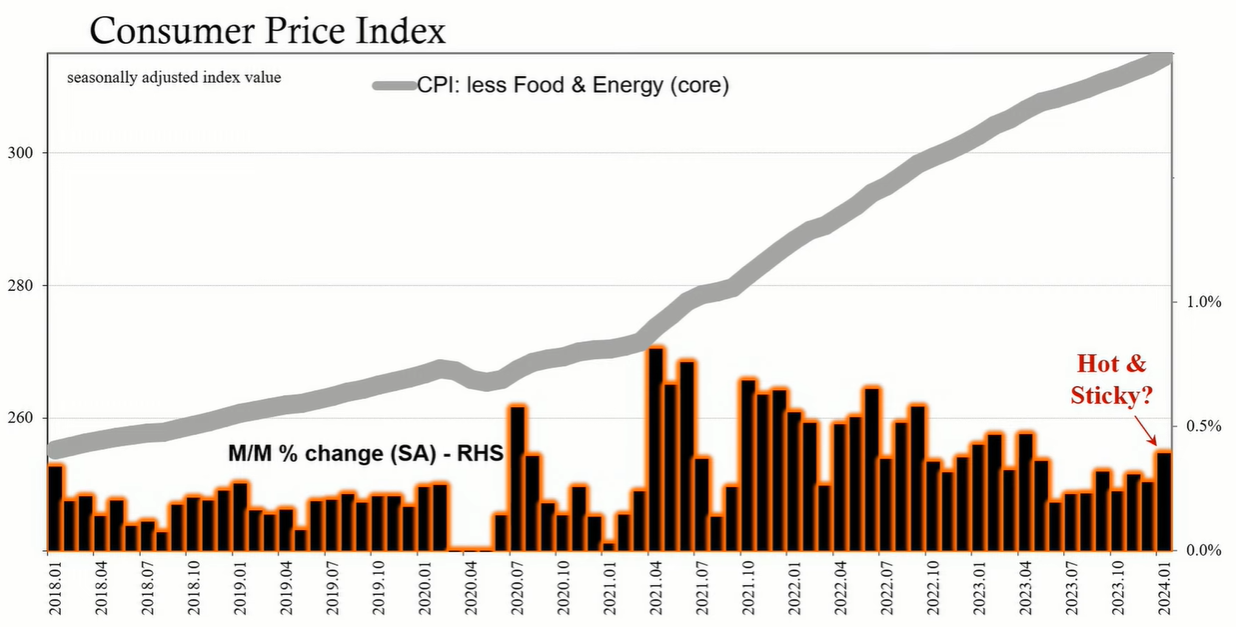

The overall monthly CPI increase was 0.3%, a relatively modest figure, but higher than the expected 0.2% and the 3.1% year-over-year rate. The core CPI, which excludes volatile food and energy prices, rose by 0.4% month-over-month. However, this increase was largely driven by shelter prices, which saw a 0.6% rise in January, notably higher than the 0.4% increase in December.

Shelter Prices and the CPI

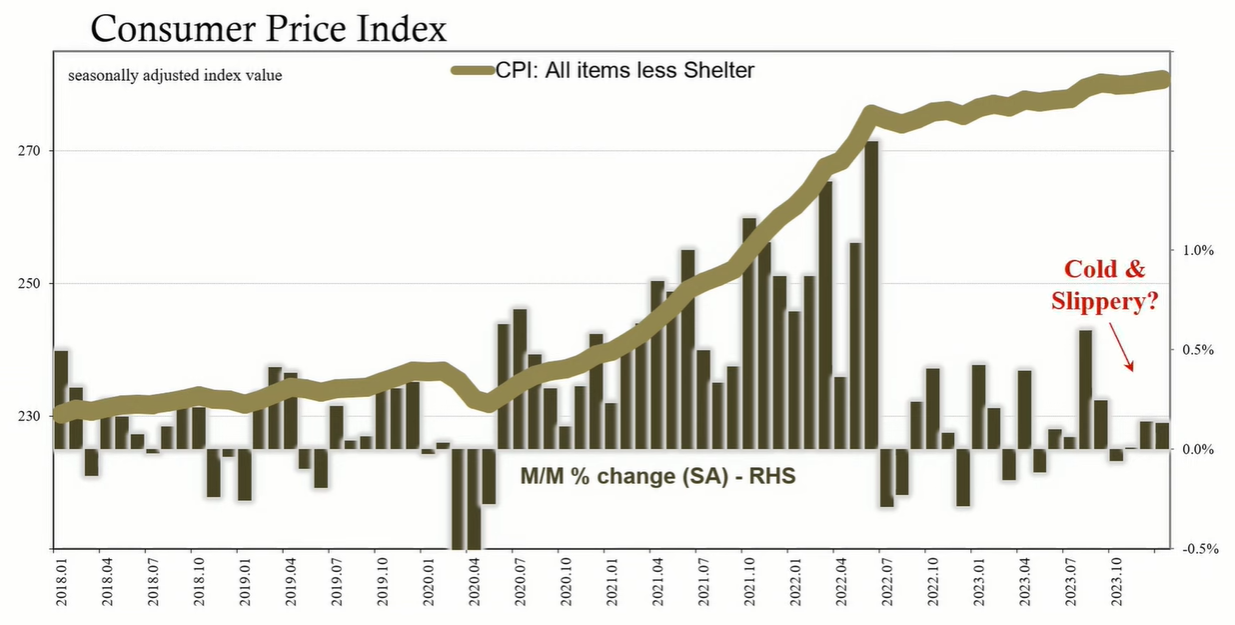

The shelter index has a significant influence on CPI calculations. Critics argue whether the index accurately represents underlying economic trends or if it is an artificially constructed measure. Excluding shelter, the "all items less shelter" index rose by just 0.13% month-over-month, indicating a disinflationary trend over the past year with a change of just 1.56%, below the Federal Reserve's 2% target.

Potential Risks and the Federal Reserve's Stance

While the current CPI data may suggest inflationary pressures due to shelter costs, the broader picture indicates potential risks of recession and liquidity problems akin to those experienced in 2011. The Federal Reserve's historical response, as seen through the transcripts of meetings from that year, was to acknowledge the transitory nature of supply shocks while simultaneously considering the risks of inflation embedding into long-term expectations.

FRB Boston President Eric Rosengren May 4, 2011

FRB Boston President Eric Rosengren May 4, 2011

Conclusion and Outlook

The current CPI data presents a complex picture, with rising shelter costs contributing to perceptions of persistent inflation, while other indicators suggest a disinflationary environment. The Federal Reserve's past experience with similar economic conditions suggests caution in interpreting these figures as signifying a turn towards sustained inflation. The broader economic context, including potential recession risks and liquidity challenges, must be considered in assessing the overall health of the economy.

Final Thoughts

The similarities between the 2011 economic scenario and the current situation are striking, though not identical. Market participants and policymakers must weigh the evidence of disinflation against the observed stickiness in consumer prices, particularly in the housing sector. The 2011 experience suggests that the current inflationary concerns may be overblown and that the economy may be on the cusp of a disinflationary period, potentially accompanied by recessionary pressures.