The Unsettling Trends in Commercial Real Estate

This post was originally published on

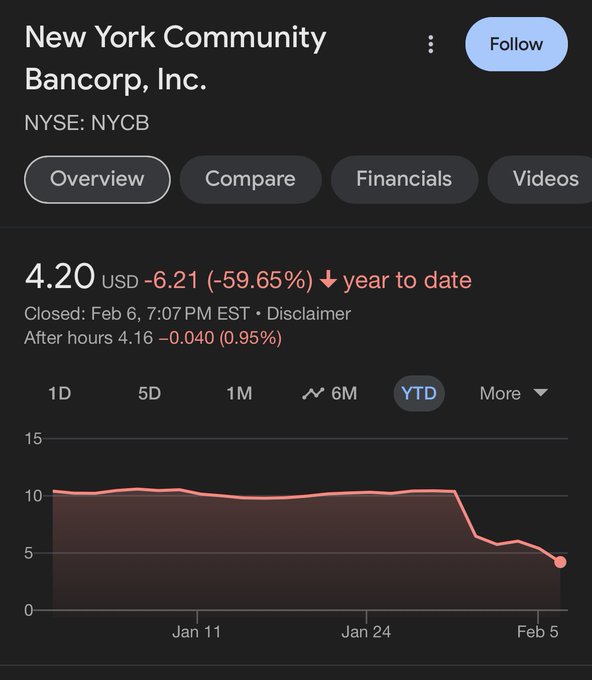

Last week's earnings from New York Community Bank Corp (NYCB) brought significant attention to the commercial real estate (CRE) market. The bank's stock plummeted nearly 50%, dragging the entire regional bank index down with it. NYCB reported a ninefold increase in charge-offs due to troubles with two commercial real estate loans, signaling potential broader issues in the CRE sector.

Commercial Real Estate Under Pressure

The CRE market has long been considered a troubled asset class, with increased vulnerability due to rising interest rates. The valuation of commercial properties, including capitalization rates (cap rates), is highly sensitive to interest rates. In recent months, banks have become more cautious, reducing loan-to-value ratios from previous standards of 65-75% to current levels of around 50-55%, reflecting heightened concern over the CRE market's stability.

The Effect of Interest Rates on CRE Values

Interest rates are a pivotal factor in the valuation of commercial properties. When rates were near zero, it resulted in inflated property values, creating a pricing bubble. However, as rates have risen, cap rates have also increased, leading to a reduction in property values—often by 20-30%, and in some cases even more. This valuation adjustment has made it difficult for property owners to support existing debt structures.

The Cash Flow Crisis

As leases expire and businesses shift to remote work, the occupancy rates in commercial properties, especially office buildings, have declined, leading to a decrease in cash flow. This reduction in revenue makes it challenging to cover operational expenses and mortgage payments. With many leases not being renewed, property owners are faced with the reality of lower occupancy, lower revenue, and potential default.

The Banking Response to CRE Challenges

Banks have pulled back from lending to the CRE market, and many loans are coming due. With properties now valued less than their loan amounts, banks and property owners are grappling with difficult decisions. Banks are closely monitoring financials and may place properties on watch lists as revenues decline and cash reserves are depleted.

Refinancing Hurdles

The ability to refinance properties has become increasingly difficult. Property owners who purchased at the peak of the market are now finding themselves with negative equity. They are unable to secure new financing without injecting significant additional capital, and in many cases, are being forced to sell at a loss.

The Role of Cap Rates in CRE Valuation

Cap rates are used to determine the value of a property based on its net operating income (NOI). An increase in cap rates translates to a decrease in property values, assuming NOI remains constant. With the current economic environment, NOI is under pressure due to decreased occupancies and increased operational costs, further exacerbating the situation.

Conclusion

The CRE market is facing a confluence of challenges, including rising interest rates, decreased occupancies, and increased operational costs. Banks are responding with increased caution, while property owners struggle to maintain cash flow and avoid default. With a lack of new investors willing to enter the market, the CRE sector is poised for a prolonged period of adjustment. As the situation unfolds, the full extent of the difficulties within the CRE market will become more apparent, with potential widespread implications for investors, banks, and the broader economy.